The commercial real estate (CRE) market is recalibrating. As we navigate today’s unpredictable and unique market cycle, your firm’s CRE debt management strategy is critical. But, if you’re subscribing to debt management myths, you could be hindering your strategy’s effectiveness.

We partnered with Wealth Management Real Estate (WMRE) for a webinar about Optimizing CRE Debt in a Changing and Unpredictable Market. Speakers Anne Hollander, Chief Strategy Officer at Defease With Ease | Thirty Capital, Jeff Lee, Managing Partner at Defease With Ease | Thirty Capital, and Zach Haptonstall, CEO and Co-Founder of Rise48 Equity, candidly discussed the state of the current CRE market and the role debt management plays in a top-performing portfolio.

Watch the webinar to hear the full conversation. Or, read ahead for some highlights from the discussion about common CRE debt management myths and tips for how to overcome them.

CRE Debt Management Myth #1: The forward curve is always accurate.

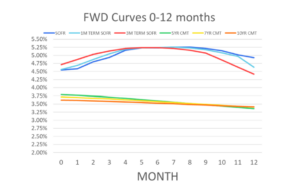

The interest rate forward curve is at a certain moment in time, a graphical representation of the market clearing forward rates for a specific index. The forward curve can be used as a baseline projection of future interest rates to support investment analysis. In most cases, borrowers can use a forward curve for both underwriting and pricing scenarios.

Despite its usefulness, the panelists agreed that the forward curve is not always accurate. Said Jeff Lee, “The forward curve is most effective when referred to at one moment in time on a specific day. It’s fine for modeling scenarios, but I wouldn’t make any drastic or monumental decisions based on the graph.”

Zach Haptonstall added to the conversation by stating that “The forward curve was probably more reliable in 2021. But when interest rates unexpectedly skyrocketed in 2022, some of the biggest institutions and private equity firms didn’t see it coming. I think that taught some people not to rely on the forward curve.”

Especially in the midst of regional bank failures, the forward curve fluctuates every couple of days. Borrowers should view the forward curve as a reference point rather than a factual guideline for decision-making. Regardless of what the forward curve says, firms can focus on taking lower leverage, having additional cash reserves, and being more conservative in their underwriting.

CRE Debt Management Myth #2: Debt management is “one size fits all”.

Debt management should not be viewed as “one size fits all” given the varying factors that must be considered when creating a strategy. Debt management strategies will usually differ based on a CRE firm’s

- Business plan and objectives

- Debt structuring

- Hedging strategies

- Debt projections

- Asset class and locations

When creating your debt management strategy, you’ll want to consider these factors. Additionally, give yourself flexibility to account for changes in the market so that you can shift your strategy as necessary.

CRE Debt Management Myth #3: Fixed rate loans are better than floating rate loans.

Fixed rate loans and floating rate loans are two of the most common types of commercial real estate loans. With fixed-rate loans, the interest rate remains the same for the life of the loan. This means that the monthly payments don’t change regardless of changes in the market. On the other hand, floating-rate loans have an interest rate that can change over time, depending on the market. This means that the monthly payments can increase or decrease depending on the market conditions.

There is an ongoing debate amongst CRE borrowers on which loan is better. During the webinar, 53% of participants shared that they are pursuing a combination between a fixed rate and floating rate strategy.

According to our panelists, there are pros and cons to both types of loans. Let’s break them down.

Fixed Rate Loans

Pros of Fixed Rate Loans

The main benefit of a fixed-rate loan is that it allows small businesses to accurately predict their monthly costs and future expenses, enabling them to budget accordingly. Fixed-rate loans are also beneficial in a high-interest-rate environment, as they provide protection from sudden changes in the economy and keep monthly mortgage payments the same. However, it should be noted that qualifying for fixed-rate loans during a high-interest-rate environment is more difficult, simply because the cost of borrowing money is higher.

Cons of Fixed Rate Loans

The main drawback of a fixed-rate loan for commercial real estate is that the interest rate remains unchanged during the entire loan term. This means that the loan will not benefit from any fluctuations in the market, and borrowers will have to pay the same monthly payments throughout the life of the mortgage. Additionally, since the interest rate is fixed, borrowers may end up paying more than they would have if they had taken out a floating-rate loan.

Floating Rate Loans

Pros of Floating Rate Loans

Generally, floating interest rates are lower compared to the fixed ones, hence, helping to reduce the overall cost of borrowing. There is always a chance of unexpected gains, but with that higher risk also comes the prospect of future gains. The borrower will benefit if interest rates decline because the floating rate on their loan will go down as well.

Cons of Fixed Rate Loans

The interest rate depends largely on market situations, which can prove to be dynamic and unpredictable. Hence, the interest rate may increase to a point that the loan becomes difficult to repay. The unpredictability of interest rate changes makes budgeting more difficult for the borrower. It also makes it harder for the lender to accurately forecast future cash flows. In times of unfavorable market conditions, financial institutions try to play it safe by putting the burden on customers. They will charge high premiums over the benchmark rate, ultimately affecting the pockets of borrowers.

How Defease With Ease | Thirty Capital Can Help

Defease With Ease | Thirty Capital is a mid-market CRE advisory & investment firm focused at the intersection of real estate, capital markets, and technology. With more than 20 years of experience in the world of commercial real estate, our team understands every operational & financial lever that drives efficiency in a real estate asset, portfolio, and investment.

We can help you model asset, debt, and equity forecasts to determine optimal timing for operational improvement, refinance, or other action so that you stay ahead of the market.

Connect with our team to learn about our detailed analysis and reports.